On June 10, 2025, the Supreme Court of India delivered a pivotal judgment: mere registration of a sale deed does not conclusively transfer ownership of a property.

While this may sound counterintuitive—after all, don’t we register deeds in our names?—the ruling clarifies that registration is necessary but not sufficient for true legal ownership.

Why Registration Alone Isn’t Enough

The Court was interpreting Section 54 of the Transfer of Property Act, 1882, which states that property above ₹100 must be transferred via registered sale deeds. However, the Supreme Court emphasized that:

- Possession, payment of consideration, and registration, though essential, are not conclusive.

- What truly matters: the chain of legal title running back to the original registered owner, free from encumbrances.

- Any gaps or defects—like unregistered agreements to sell or GPAs—can break that chain.

Case in Point: Sanjay Sharma vs. Kotak Mahindra Bank

The ruling emerged from a dispute under the SARFAESI Act. A bank auctioned a Delhi basement after recovering dues. The purchaser, Sanjay Sharma, got the sale certificate and registered the deed. But a third party, Mr. Vij, claimed ownership based solely on:

- An unregistered agreement to sell, and

- A registered GPA that didn’t involve executing a sale deed.

The Supreme Court found that neither document conferred title. The GPA granted authority but no transfer of ownership, and the unregistered agreement was legally insufficient.

The Court restored the buyer’s registration and possession, ruling the prior claims legally invalid.

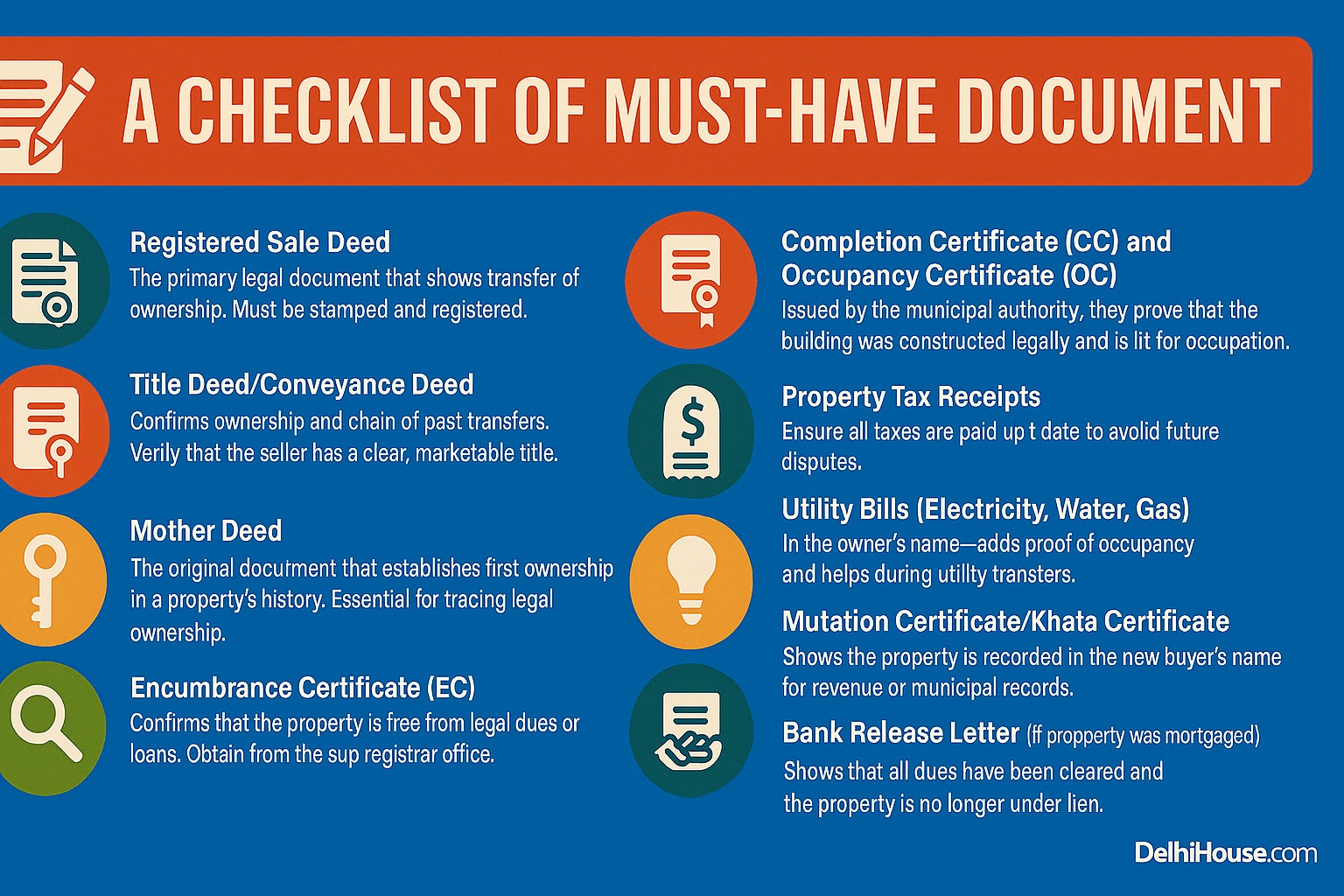

A Checklist of Must-Have Documents

To protect your investment and prove full ownership, here’s a definitive checklist of documents you should possess:

Registered Sale Deed

The primary legal document that shows transfer of ownership. Must be stamped and registered.Title Deed/Conveyance Deed

Confirms ownership and chain of past transfers. Verify that the seller has a clear, marketable title.Mother Deed

The original document that establishes first ownership in a property’s history. Essential for tracing legal ownership.Encumbrance Certificate (EC)

Confirms that the property is free from legal dues or loans. Obtain from the sub-registrar office.Possession Letter

A document handed over by the seller/developer confirming physical transfer of the property.Completion Certificate (CC) and Occupancy Certificate (OC)

Issued by the municipal authority, they prove that the building was constructed legally and is fit for occupation.Property Tax Receipts

Ensure all taxes are paid up to date to avoid future disputes.Utility Bills (Electricity, Water, Gas)

In the owner’s name—adds proof of occupancy and helps during utility transfers.Mutation Certificate/Khata Certificate

Shows the property is recorded in the new buyer’s name for revenue or municipal records.No Objection Certificates (NOCs)

If applicable—from the housing society, builder, or bank (if the seller had a loan).Bank Release Letter (if property was mortgaged)

Shows that all dues have been cleared and the property is no longer under lien.

Practical Implications for Buyers, Sellers, Banks, and Lawyers

This ruling raises the bar for due diligence:

Banks and lenders:

Must scrutinize encumbrances—even unregistered ones—when granting loans or conducting auction sales.Buyers:

Should not just verify registration but also demand complete title searches, legal opinions, and encumbrance certificates.Sellers

:Must ensure their title is clean and that all prior transactions were legally valid.- Lawyers:

Need to emphasize title insurance, document audits, and clearance certificates as part of routine checks.

Conclusion: A Call for Deeper Diligence

This Supreme Court ruling is a game-changer. It signals that real estate isn’t just about paperwork—it’s about the legal pedigree of property.

Parties must now place greater importance on tracing the full history of ownership—not just verifying what’s on paper today.

By reinforcing a meticulous approach, the Court aims to reduce fraud, protect honest purchasers, and sustain market integrity.

For anyone dealing with property—buyers, banks, lawyers—this is a powerful reminder: registration is necessary, but only as part of the story, not the whole story.